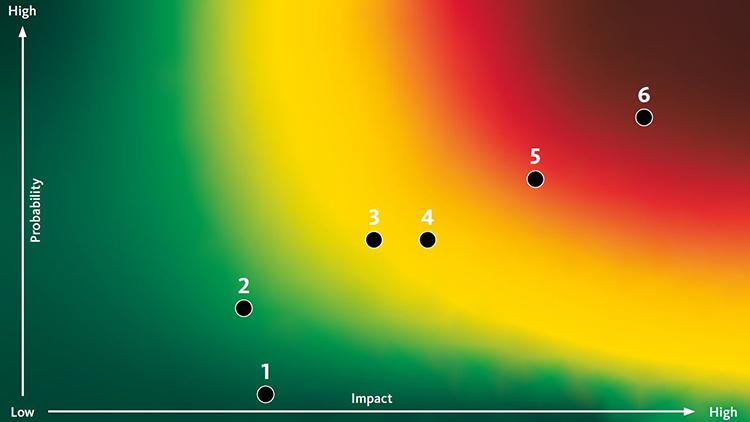

The European Insurance and Occupational Pensions Authority (EIOPA) published today its Consumer Trends Report with a risk heat-map providing a snapshot of the impact of the COVID-19 crisis on the insurance and pension sector from a consumer protection perspective as of 30 June 2020.

Despite initial concerns, insurers and pension funds have maintained business continuity. Buying products, submitting claims and complaints, or seeking information have carried on broadly as normal — though in new forms as digitalisation trends have accelerated. When consumers may have found themselves in breach of contractual obligations because of the forced changes in habits and behaviours, insurers have shown forbearance.

While the full extent of the effects of COVID-19 on consumer trends is still to be revealed, EIOPA identified a number of key issues emerging from this initial crisis phase:

- Existing concerns in relation to unit-linked products have intensified. Structural problems linked to the features of some of these products, such as high and complex costs, or unusual or complex risk profiles, can be exposed by early surrenders as consumer’s face unexpected needs for liquidity. Expected lower returns and market volatility can also further intensify these problems.

- Approaches to exclusions varied across markets, products and undertakings. In some markets, insurers systematically have excluded pandemics from their contracts, while in others the consumer faces uncertainty over the coverage for different products. The crisis highlighted a lack of clarity in terms and conditions, and the complexity or ambiguity of contracts. In some instances court interventions have been required. Many insurers have not been proactive in communicating in a clear and timely way on this issue.

- Problems for travel insurance products surfaced, both in relation to exclusions but also in relation to changes in the risk profile for which the products were sold, as well as lack of remedial measures to address resulting consumer detriment. However, many travel insurers have also taken goodwill measures and extended coverage particularly to consumers stranded abroad.

- For some products the risk profile being covered decreased materially, raising questions as to their capacity to meet the needs of the target market, yet initiatives for addressing such changes in risk profile were not widely spread.

COVID-19 has also taken its toll on the pension sector. In particular, cases of lower pension contributions emerged where savers were not able to continue contributions, due for instance to business shrinking or due to unemployment. Further risks in the decumulation phase may crystalise, with the potential to lead to future cuts in benefits.

To alleviate the impact of the COVID-19 outbreak on the insurance and pension sectors, whilst ensuring fair treatment of consumers, national supervisory authorities as well as the insurance and pensions sectors have taken specific measures. As the crisis continues to unfold with potential impacts on profitability, conduct risks can be expected to continue to crystallise and emerge. It is therefore of great importance that concerns regarding financial exclusion, contract clarity, and unit-linked products are adequately addressed and mitigated.

Details

- Publication date

- 29 January 2021