Infographics and visuals on some key activities

EIOPA's factsheet on IORPs, based on 2024 data, provides insights into how European IORPs allocate the approximately €2.7 trillion they manage across different asset types and jurisdictions.

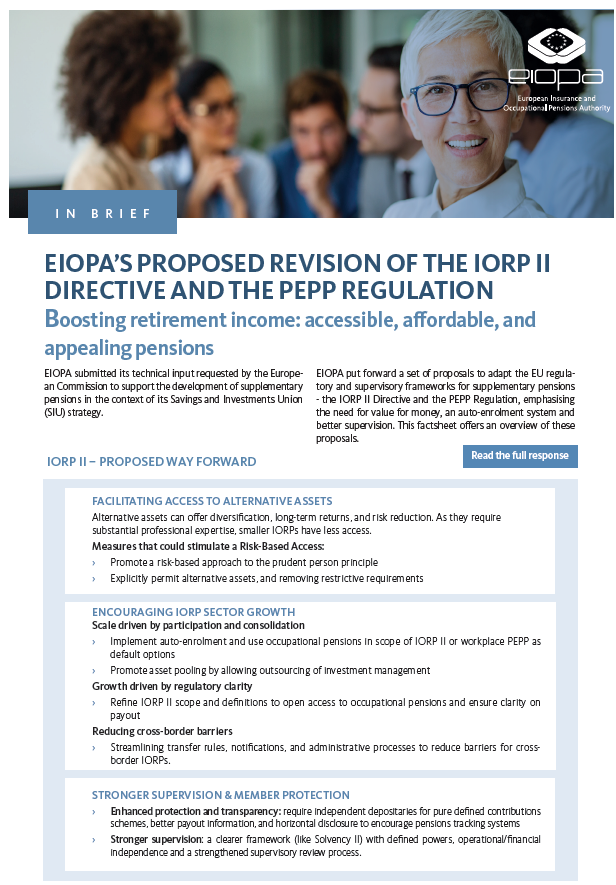

EIOPA submitted its technical input requested by the European Commission to support the development of supplementary pensions in the context of its Savings and Investments Union (SIU) strategy. EIOPA put forward a set of proposals to adapt the EU regulatory and supervisory frameworks for...

Catastrophes such as extreme floods, fires, and earthquakes have a damaging effect on the society and cause significant losses. Such losses will only increase in the coming years as global temperatures rise. This has significant consequences for the insurance industry, EU citizens and businesses. In...

Pensions ensure future financial security for you and your family. In this factsheet, you will learn more about EIOPA's recommendations, as well as about the steps we can take to save for retirement.

The factsheet summarises the key findings of the IORPs in Focus Report 2024, providing a visual overview of the main trends in Europe's IORP sector.

The factsheet provides an overview of the investments of EEA-based insurance groups. Specifically, it shows to what extent European insurers’ direct equity and corporate bonds investments in the EEA align with the EU Taxonomy for environmentally sustainable activities.

Find out in a nutshell what are the key priorities for EIOPA in the coming period. The Single Programming Document 2025-2027 sets out EIOPA’s strategy and work programme for the coming years and includes the Annual Work Programme for 2025.

In view of the new EU institutional cycle, EIOPA is providing a short overview of the insurance and pensions sectors in Europe, EIOPA’s role and priorities, and areas for possible future work together.

The use of AI in insurance is already subject to insurance sector regulation and supervision. While the AI Act introduces some additional requirements for providers or deployers of high-risk AI systems, insurance sector legislation continues to apply across all use cases, regardless of their...

This factsheet offers a summary of the main activities EIOPA carried out in 2023 as a member of the colleges of supervisors. It highlights the importance of efficient and effective coordinated supervision of cross-border insurance groups in the EU and provides an overview of the main developments...

In this factsheet, we present the findings of a peer review that explored how national supervisors across the EU assess insurers’ compliance with this principle. To keep the review targeted, EIOPA chose to concentrate on some aspects of the principle, namely, the supervision of non-traditional and...

A year after IFRS 17’s entry into force, this factsheet offers insights into its initial implementation and highlights how certain aspects of the new standard differ from Solvency II - based on a sample of 53 (re)insurance groups. For more information and deeper analyses, read EIOPA’s full report on...

In this fact sheet, we focus on the investments of Institutions for Occupational Pensions Provision (IORPs) in equity and corporate bonds, to which IORPs allocated 29% of their €2.5 trillion investments as of Q3 2023. Within these categories, the analysis focuses on securities issued by issuers in...

Discover the key trends in the insurance and occupational pensions in 2023.

The charts in this factsheet provide valuable insights into the number of intermediaries, their remuneration structures, challenges in insurance distribution, and the most commonly exercised national options under the IDD by member states.

The factsheet provides answers to frequently asked questions and steps consumers can take to understand how their financial choices could contribute to a more sustainable future.

The graphs in this factsheet show the size of the IORPs market in terms of assets, members as well as contributions and benefits.

The factsheet summarises EIOPA's strategic priorities for 2024-2026. EIOPA will focus on managing the uncertainty in times of transformation so that the insurance and pensions sectors can continue to deliver value to policyholders and beneficiaries, to business and the EU economy.

This factsheet gives a global view on the occupational pensions sector in Europe in 2023. It looks at the size of the IORP sector, at how developed it is across Europe and highlights some recent trends.