While behavioural insights can and should be used in the interest of consumers, unconscious biases can also be deliberately used by companies to persuade consumers to purchase products that do not necessarily meet their needs, their objectives or risk profile.

In this section we look at some misleading techniques that exploit consumers’ cognitive biases, also called “dark patterns” that have been identified on different websites of European insurance companies.

Social proof

Social proof is a psychological and social phenomenon wherein people copy the actions of others when they feel uncertain in an attempt to reflect correct behaviour for a given situation. Social proof works by tapping into the basic human instinct to follow the actions of others, building trust and credibility, and lowering barriers to making purchases online (Cialdini, 2009).

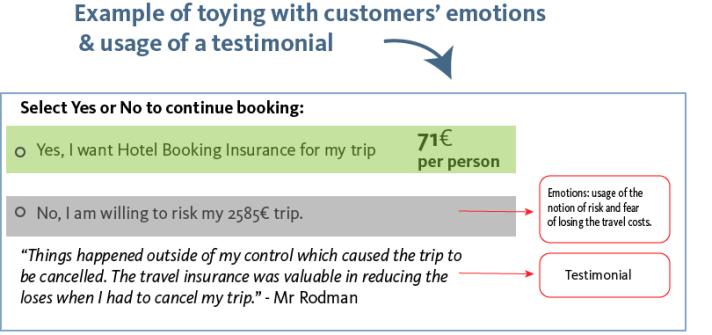

Testimonials are a form of social proof that may induce consumers to follow and copy the actions of other people. Testimonials and user feedback usually display positive reviews and lack any negative experiences, or details on services or products. Furthermore, the online environment makes it difficult to differentiate between genuine and fake testimonials.

An example of social proof and testimonial used by an insurance website: “92% of our customers stay with us”.

Toying with emotions

Consumers’ judgement can be influenced by eliciting consumers’ emotions and by exploiting them, leading to biased decision.

Forced action

Forced actions or fake actions induce consumers to believe that they cannot get a quote or make a comparison without following the indications of an online platform. This may lead consumers to disclose personal information that they wouldn’t have shared otherwise.

In such cases, consumers may think that registration or consent is necessary before continuing.

Sense of urgency

Consumers are falsely informed that a product is only available for a limited period of time or in limited quantities. This practice leverages on the fear of missing out and discourages users to read all the information available.

Pre-selected option

Websites, including insurance websites, sometimes use pre-selected or default options which are not necessarily in the interest of consumers.

This technique can induce the belief that those options are in their best interest or that this is the only possibility to move ahead with the purchase.

This technique was found on insurance companies websites in different instances, such as:

- when entering personal data

- when confirming and giving privacy consent

False hierarchy

False hierarchies are used to promote a certain option or, on the contrary, to hide certain options. By using brighter colours or a bigger font size, users can be guided to take certain actions such as accepting cookies or reconsidering a decision, such as to delete an account. As a consequence, this technique influences the weighting of factors in consumer decision-making.

Example of false hierarchy and pre-selected option:

Hidden information

Hidden information involves deliberately hiding relevant information from consumers, which prevents them to focus on key aspects of the purchase.

Practices include:

- using very small letters

- using less visible colours

- placing the information within long terms and conditions

- presenting relevant information after several clicks

By hiding important information or by including salient buttons such as “continue“, or “accept”, consumers are pushed to continue or to finalise a purchase before accessing relevant information on that purchase.

The perceived pressure, coupled with the inaccessibility of important information, can lead consumers to make rushed decisions based only on shortcuts.

Prize contest

This technique is based on the promotion of a prize in order to nudge consumers to share their e-mail addresses while comparing quotes, such as for car or motor insurance. Once the e-mail address is entered, then the users will continue receiving promotions and other emails from the provider. At the same time, a prize contest can potentially induce the consumer to opt for a certain insurance company even if the policy offered is not the most suitable.