Insurance Risk Dashboard May 2024 (Q4-2023 Solvency II Data)

Key observations:

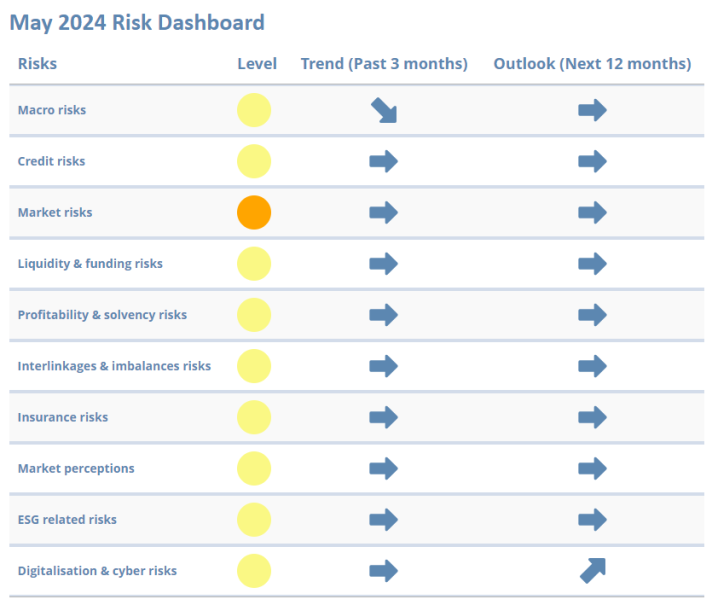

The European Insurance and Occupational Pensions Authority (EIOPA) published today its May 2024 Insurance Risk Dashboard, which shows that risks in the EU’s insurance sector are stable and overall at medium levels, with pockets of vulnerabilities stemming from market uncertainty and potential risks in the real estate sector.

On macro risks, while some forward-looking indicators have eased and point to positive developments, GDP growth remains relatively low by historical standards. Credit risks are steady following a slight decrease in credit default swaps spreads. Nevertheless, credit risks require close monitoring as insurers maintain a high exposure to sovereign and corporate bonds. Market risks pose challenges driven by market volatility and declining commercial real estate prices in the first half of 2023.

Liquidity and funding risks remain stable at a medium level, yet lapse rates have increased at the end of last year and are being closely monitored. Profitability and solvency risks are also stable at a medium level, with improved returns in end-2023 compared to 2022 and overall stable solvency ratios in Q4-2023 compared to previous quarters of 2023.

Insurers’ interlinkages and imbalances with other parts of the financial system are closely watched. Insurers’ exposure to financial activities other than banking and insurance increased slightly in the last quarter of 2023. Regarding Insurance risks, premium growth has been positive for both life and non-life segments and there was a slight deterioration in the median loss ratio.

ESG-related risks are stable with no signs of relevant changes in the indicators monitoring transition and physical risks.

The materiality of Digitalisation & Cyber risks in the first quarter of 2024 as assessed by insurance supervisors slightly increased, as well as the indicator on cyber negative sentiment.

Download the full Dashboard

Note:

- Reference date for company data is Q4-2023 for quarterly indicators and 2022-YE for annual indicators. The cut-off date for most market indicators is end March 2024.

- Risk Levels are based on a 4-level scale from Low (green) to Very high (red). Risk trend reports the quarter on quarter variation of the risk based on a 5-level scale from Substantial Decrease to Large Increase.

Previous Dashboards

EIOPA's previous Insurance Risk Dashboards are available here.