This year for International Women’s Day on 8 March, EIOPA chose to highlight the gender gap in insurance and pensions.

As the Chairperson of the European Insurance and Occupational Pensions Authority, I often reflect on the pressing issue of gender balance within insurance and pensions. It's a topic that not only resonates with me personally but also holds significant implications for our society.

The gender gap: a closer look at the numbers

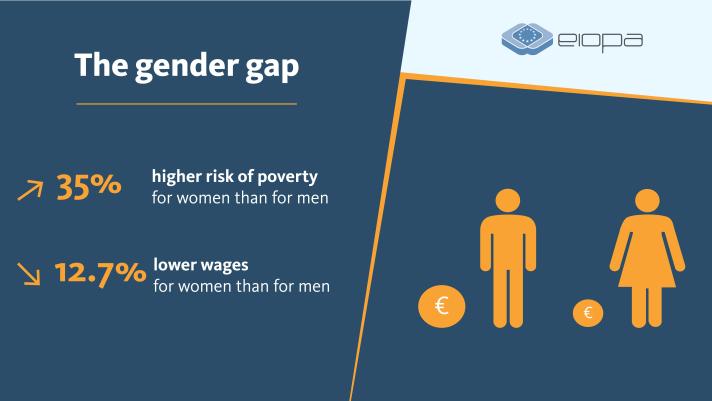

When we delve into statistics, we uncover a sad reality for women in Europe. Approximately 17 million Europeans are at risk of poverty or social exclusion. Women, however, are bearing a heavier burden, as the risk of poverty is almost 35% higher for women than for men.

The gender pay gap further exacerbates these challenges, with women in the European Union earning, on average, 12.7% less than their male counterparts in 2022. This wage disparity not only undermines women's economic autonomy during their working years but also has long-term implications for their retirement savings and pension benefits.

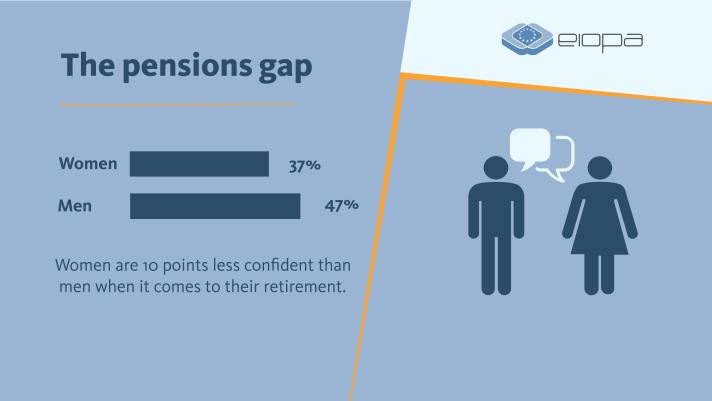

Women are concerned about their retirement. Our latest Eurobarometer survey reveals a troubling reality: only 37% of women are confident in living comfortably when they retire, compared to 47% of men. Indeed, they have good reason to be concerned, as women aged 65 and above receive pensions that are, on average, 29% lower than those received by men in the EU.

When it comes to insurance, women face additional hurdles in accessing insurance products and services. In fact, 45%* of female consumers feel unfairly targeted by exclusions in insurance contracts, highlighting the need for greater transparency and accountability in the industry.

Taking action to bridge the gender gap

In light of these facts and figures, it's clear that action is needed to bridge the gender gap in insurance and pensions. We need to address both systemic barriers and cultural biases that lead to inequality.

Policies such as the equal pay directive play a crucial role, as the gender pay gap significantly contributes to the pension gap. At EIOPA, we advocate for a more extensive implementation of pension dashboards and tracking tools to monitor the gender pay and pension gaps effectively.

We also advocate for gender-neutral remuneration policies and practices in occupational pensions, as included in our advice to the review of the IORP 2 Directive.

Furthermore, we must challenge biases that underpin discriminatory practices in the insurance industry, particularly regarding pricing and coverage. By promoting greater transparency and accountability, we can ensure that insurance products are fair and equitable for all consumers, regardless of gender.

A call to action for gender equity

In conclusion, we all need to take action to achieve gender equity in insurance and pensions and in all society as a whole.

By addressing the root causes of gender disparities and implementing meaningful actions, we can create a more inclusive and resilient society where all individuals have the opportunity to thrive, both during their working years and in retirement.

*This figure was amended on 03 April 2024.

Sources:

Details

- Publication date

- 26 March 2024

- Author

- Petra Hielkema