EIOPA carries out regular insurance stress tests to assess how well the European insurance industry is able to cope with severe but plausible adverse developments of financial and economic conditions. Stress test results help supervisors identify the vulnerabilities of the insurance industry and find ways to improve its resilience. The 2021 stress test exercise focused on a prolonged COVID-19 scenario in a “lower for longer” interest rate environment and evaluated its impact on the capital and liquidity position of the entities in scope.

Results

Despite the grave economic and financial implications of the COVID-19 pandemic, the European insurance industry entered the stress test exercise with a strong level of capitalisation.

- This robust buffer allowed participants to absorb the shock of the adverse scenario.

- The capital component of the exercise confirmed that the main vulnerabilities for the sector stem from market shocks, and, specifically, from the decoupling of the risk free rate and risk premia, the so-called double-hit scenario.

- The insurance industry demonstrated that it has tools at its disposal to cope with adverse market and economic effects (reactive management actions)

- Long-term guarantees measures, which are part of the Solvency II regulation, helped absorb part of the severe but plausible shocks, limiting the drop in participants’ solvency ratio.

- Nevertheless, the stress test also revealed that a section of the market still heavily relies on transitional measures, which, unlike long-term guarantees, are to be phased out by 2032

The liquidity component of the stress test showed that the liquidity position of participants appears to be a less significant concern than solvency positions given the sector’s large holdings of liquid assets. Still, outcomes show that insurers cannot rely solely on their cash holdings to cover unexpected outflows.

More detailed information on the results and on the procedural and technical aspects of the exercise can be found in the following documents:

Objective

The 2021 stress test exercise aimed to assess the resilience of the participants to the adverse scenario(s) by a capital and liquidity perspective in order to provide supervisors with information on whether these insurers are able to withstand severe but plausible shocks.

While not being a pass/fail exercise, the 2021 exercise had a mainly microprudential approach. It allows EIOPA to make recommendations to the industry and enables supervisors to ask insurance undertakings to take remedial actions, when needed, in order to improve their resilience.

The microprudential assessment is complemented by the estimation of potential spillover from the insurance sector triggered by widespread reactions to the prescribed shocks.

Scenario

The 2021 stress test exercise focused on a prolonged COVID-19 scenario in a “lower for longer” interest rate environment.

The scenario, developed in cooperation with the ESRB, elaborates on the ongoing concerns about the possible evolution of the COVID-19 pandemic and its economic ramifications, which can trigger adverse confidence effects worldwide and prolong the economic contraction. The narrative is translated into a set of market and insurance specific shocks that generate a severe but plausible “double-hit” effect to the insurance industry.

For detailed information on the scenario and on the shocks, see the ESRB Adverse scenario for the EIOPA 2021 Stress Test, the Technical information and in the Technical specifications.

Approach

The 2021 Stress Test exercise assessed the resilience of the European insurance industry by a capital and liquidity perspective:

- the capital assessment relies on the Solvency II framework;

- the liquidity assessment is based on the estimation of the sustainability of the liquidity position.

Participants are requested to estimate their position under two assumptions:

- Fixed balance sheet;

- Constrained balance sheet.

For detailed information on the approach see the Technical Specifications.

Scope

The 2021 exercise targets European (re)insurance groups. The selection of the participating entities is mainly based on size, EU wide market coverage, business lines conducted (life and non-life business) and number of represented jurisdictions.

The local market coverage was taken into account in a second stage.

The target sample defined in cooperation with the National Competent Authorities (NCAs) covers 75% of the EU-wide market based on total assets in the Solvency II.

The list of the undertakings in scope of the 2021 Stress Test exercise is reported in the Technical Specifications.

Working process

Preparation phase

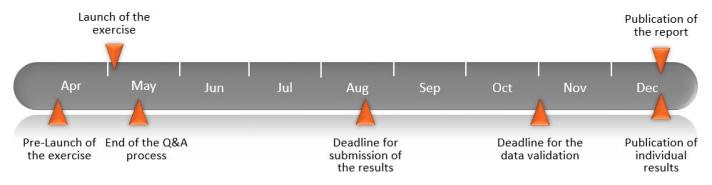

EIOPA has consulted relevant stakeholders and participants during the preparation of the stress test package.

- From mid-January to end-March: EIOPA carried out technical discussions with stakeholders (Insurance Europe, AMICE, CRO Forum, CFO Forum, Actuarial Association of Europe) and participants on the main elements of the exercise;

- From mid-April to mid-May: EIOPA carries out consultations with participants in the form of Question and Answers to provide clarifications and improve the stress test package. Participants can submit requests for clarification on the Stress Test exercise to their National Supervisors by 10 May 2021. See the national contact points and the template for the submission of the request, as well as the updated list of the Q&A received.

Calculation phase

- From the launch of the exercise (7 May 2021) to the deadline for submission of the results to the National Authorities (13 August 2021) participants are requested to calculate the results and indicators according to the prescribed scenarios.

Validation phase

- From Mid-August to end October : Quality assurance of the results split into local quality assurance and central quality assurance. During the validation period, participants might be requested to provide clarifications or resubmit part of the results.

Analysis of the results

- November and December: analysis of the results and drafting of the report.

Publication of the results

The outcome of the 2021 Stress Test will be published in December in two forms:

- Report based on aggregated data;

- Publication (upon consent of the participants) of a subset of capital based indicators.

Related resources

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023

- 31 JANUARY 2023